Following the release of Houlihan Lokey’s Snacking Market Update, James Scallan, Managing Director in Houlihan Lokey’s Consumer Group, shares his outlook on the snacking sector’s M&A landscape.

With consumer preferences shifting towards health-conscious, sustainable options, and corporate buyers increasingly active, Scallan sees immense opportunity for strategic growth in snacking. In his view, the sector is poised for continued expansion, driven by premium acquisitions and innovations that meet evolving consumer demands.

What key trends are fuelling M&A activity in the snacking sector?

A broader trend we’ve observed is the significant presence of corporate buyers in the M&A activity within the wider food and beverage sector, and this holds true for the snacking market as well. Many corporates are coming off strong financial performances, bolstered by healthy cash flows and robust balance sheets. This financial stability allows them to pursue acquisitions that prioritise long-term efficiencies over short-term growth.

Corporations are strategically seeking deals that enable geographic expansion or diversification of product lines, particularly in rapidly growing segments – which snacking is certainly one. The shift towards healthier eating has bolstered interest in ‘better-for-you’ and ‘healthy indulgence’ snacks, creating opportunities for companies that can innovate in this space. By acquiring businesses that align with trends like healthier eating and sustainable sourcing, they aim to reinforce their market positions while capitalising on evolving consumer preferences.

Additionally, the increased frequency of snacking occasions, driven by busier lifestyles and an expanding variety of snack formats, has sustained consumer demand. Strategic buyers, including private equity firms, are particularly drawn to premium assets within the sector. This appetite is reflected in the rise of ‘mega deals’ in 2024, such as Mars’ acquisition of Kellanova, the largest in snacking history.

Which snack categories are expected to see growth or decline in the coming years, and what factors will influence these shifts?

Looking ahead, the snacking sector is poised for continued growth, with initial signs of recovery appearing as economic conditions improve. As interest rates continue to normalise and visibility of performance increases (including volume recovery and inflation pass-through), an uptick in M&A activity is expected as we approach 2025. Activity is likely to intensify as private equity grows more competitive with improved debt availability and pricing. Additionally, improving consumer confidence as a result of easing cost-of-living pressures should lead to an improved trading environment.

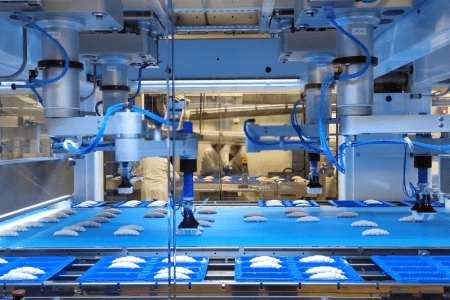

Consumer demand for health-conscious snacks will continue to drive growth in “better-for-you” options that prioritise natural ingredients and address dietary needs like gluten-free, plant-based, and low-sugar options. Additionally, a growing emphasis on sustainability is driving innovations in eco-friendly packaging, with many companies responding to consumer preferences for environmentally responsible products.

What potential obstacles could hinder growth across snack categories?

Strong underlying tailwinds promise growth as inflation and interest rates stabilise and sentiment improves, though supply chain pressures and raw material costs remain significant challenges. While branded snacks benefit from consumer loyalty, ongoing price sensitivity could continue to hinder growth volume.

Read more latest industry news and developments in our free to download magazine.

Never miss a story… Follow us on:

International Bakery

@int_bakery

@Bakeryint

Media contact

Joseph Clarke

Editor, International Bakery

Tel: +44 (0) 1622 823 920

Email: editor@in-bakery.com