AAK’s Interim report for the second quarter of 2022 showed that it was a strong quarter despite high volatility and a demanding macro-economic climate.

They report that total volumes have increased by 1%, to 554,000 MT (550,000). The operating profit, excluding items affecting comparability (adjusted operating profit), but including a positive currency translation impact of SEK 84 million, increased by 15 percent, reaching SEK 624 million (541). At fixed foreign exchange rates, operating profit was flat.

AAK reported an item affecting comparability (IAC), a cost of SEK 350 million, related to the decision to exit the Russian market. Profit for the period amounted to SEK 160 million (103). Excluding IAC, profit for the period amounted to SEK 479 million (389). Earnings per share amounted to SEK 0.60 (0.39). Excluding IAC, earnings per share amounted to SEK 1.83 (1.51). Cash flow from operating activities amounted to positive SEK 55 million (positive 231). Return on Capital Employed (ROCE), R12M, was 15.0 percent (15.6 at December 31, 2021).

Within food ingredients, operating profit, excluding IAC, increased by 18 percent to SEK 406 million (343). In Chocolate & Confectionery Fats, operating profit, excluding IAC, reached SEK 216 million (205), an increase by 5 percent. And in technical products and feed, operating profit, excluding IAC, reached SEK 46 million (31), an increase by 48 percent.

CEO’s comments

“The war is affecting the global economy and adding to already high inflationary pressures and volatility, contributing to a demanding macro-economic climate. During the quarter, raw material prices traded at record levels and costs for transport and logistics remained high. In addition, Indonesia implemented an export ban on palm oil at the end of April, which was lifted towards the end of May. Despite these challenges, we delivered a strong second quarter. Volumes increased by 1 percent and both operating profit as well as operating profit per kilo grew by 15 percent, excluding items affecting comparability. All business areas contributed to the increase in operating profit, which was the highest ever for a second quarter – indeed a great achievement, made possible by our dedicated and hard-working employees around the world.

Chocolate & Confectionery Fats delivered a solid quarter, with volumes up by 7 percent and operating profit, excluding items affecting comparability, up by 5 percent. This is a good result given our decision to wind up our operations and investments in Russia.

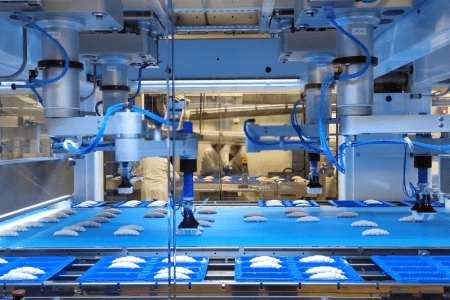

Food Ingredients reported a strong quarter with operating profit up by 18 percent, excluding items affecting comparability. The increase was mainly driven by Foodservice and Bakery. Volumes for the business area declined by 2 percent, primarily due to our continued prioritization of speciality and semi-speciality solutions within Bakery. Dairy volumes increased and Foodservice continued to grow compared to last year. Speciality fat systems for Plant-based Foods showed strong growth, driven by Plant-based Dairy.

Technical Products & Feed reported yet another strong quarter, with operating profit up 48 percent. This was driven by improved profitability in both our feed and natural ingredients businesses.

Despite the challenges and uncertainties that we faced throughout the second quarter, we continued to navigate well and delivered a strong result. As an important supplier of plant-based ingredients for food and technical products, we are well positioned to manage risks and to deliver value – something we have proven in the past few years’ very dynamic environment.

Despite continued short- to mid-term uncertainty, we see no reason to adjust our view on the strong favorable underlying long-term trends in our markets. Thus, we remain prudently optimistic about the future, and we are fully committed to Making Better Happen.”

Read more latest industry news and developments in our free to download magazine.

Media contact

Editor, International Bakery

Tel: +44 (0) 1622 823 920

Email: editor@in-bakery.com