Global market research company Euromonitor has recently released its consumer trends report, which reflects the top 10 consumer trends for this year.

The report, which is released annually by Euromonitor, aims to help organisations and companies stay ahead of disruption, predict consumer shopping motivations and fulfil any unmet consumer needs.

Findings of the report reflect that consumers are spending more responsibly but also emotionally, as the role of the digitisation in purchasing processes, female equality demands and a “disruptive Gen Z” are some of the major factors that will influence global consumer trends this year.

The 10 key trends outlined are as follows:

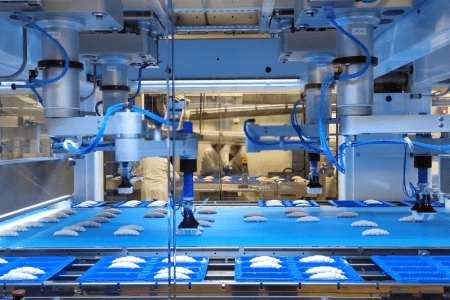

- Authentic automation – keeping humans and machines in sync, as tech benefits outweigh the need for personal interactions

- Budgeteers – the cost-of-living crisis is undermining purchasing power for consumers, as in 2022 75% of consumers reported they did not plan to increase their overall spending

- Control the scroll – screen time is more selective, as consumers seek an efficient and curated digital experience

- Eco economic – consumption behaviours are more about reduction, ensuring a positive impact on the planet as 43% of consumers reduced their energy consumption last year

- Game on – gaming has become an “entertainment leader” and is now an opportunity for the market to capitalise on

- Here and now – in 2022, buy now pay later reached a total of US$156 billion lending value

- Revived routines – in the post pandemic period, consumers are willing to rediscover the world as 39% of consumers said more of their everyday activities will be in person over the next five years

- She rises – consumers are seeking out equity and inclusivity

- The thrivers – 53% of consumers had a strict boundary between work or school and personal life in 2022

- Young and disrupted – Gen Z stand up for their beliefs and are resistant to traditional advertising

“The past few years have been anything but ordinary, and 2023 will be no exception,” explained Alison Angus, Head of Innovation Practice at Euromonitor International. “Companies should expect quite divergent behaviour as consumers cope with ongoing challenges while getting back in their stride.”

As the cost-of-living crisis hits, UK consumers have reined in their shopping spends, which have proved a concern for bakery businesses already facing supply chain disruption and skyrocketing energy costs. Speaking to David Wagstaff, Managing Director of St Pierre Groupe, he said in spite of this, there are still opportunities to be found: “There will be two camps of shoppers: those who spend a little extra knowing they’re getting a better-quality product and become brand loyal; and those who don’t spend the extra, but then don’t have an experience that keeps them coming back.“

Read more latest industry news and developments in our free to download magazine.

Never miss a story… Follow us on:

![]() International Bakery

International Bakery

![]() @int_bakery

@int_bakery

![]() @Bakeryint

@Bakeryint

Media contact

Caitlin Gittins

Editor, International Bakery

Tel: +44 (0) 1622 823 920

Email: editor@in-bakery.com