Ingredion Incorporated, a global provider of ingredient solutions to the food and beverage manufacturing industry reported results for the first quarter of 2022. The results, reported in accordance with U.S. generally accepted accounting principles (“GAAP”) for 2022 and 2021, include items that are excluded from the non-GAAP financial measures that the Company presents.

“Ingredion overcame inflationary headwinds and is off to a strong start in 2022,” said Jim Zallie, Ingredion’s president and chief executive officer. “We delivered 17% net sales growth driven by higher-than-expected demand and strong price mix. In a highly inflationary environment, we achieved significant, favorable price mix that more than offset increased input costs and contributed to 6% operating income growth. We also made progress in the quarter improving the resilience of our supply chain despite continued global logistics constraints, which enabled us to better meet customers’ changing needs.”

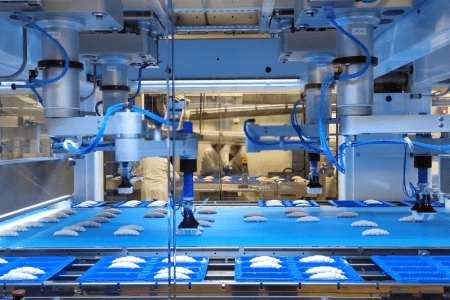

“We continued to advance our Driving Growth Roadmap, growing our specialties ingredients net sales by 20% in the quarter, led by strong demand for texturizing ingredients. Additionally, plant-based proteins net sales grew more than 250% in the quarter, as our quality and yield improved and our production ramp-up accelerated at our two manufacturing facilities. PureCircle also achieved another high double-digit net sales growth quarter, reflecting strong demand for high intensity, nature-based sweeteners,” stated Zallie.

“As we started 2022, new challenges arose, and our team continued to show exceptional agility in responding to events such as the dislocations brought on by the Ukraine conflict, its impact on global corn supply, and, most recently, the resurgence of the pandemic in China. I am incredibly proud of our people as they operate with an owner’s mindset to adapt and engage each day to create value for our stakeholders. We look forward to a year of meaningful growth, as we leverage technology and the best of nature, to deliver an expanding set of innovative ingredient solutions for our customers and consumers alike.”

Financial Highlights

- At March 31, 2022, total debt and cash including short-term investments were $2.3 billion and $329 million, respectively, compared to $2.0 billion and $332 million, respectively, at December 31, 2021.

- Net financing costs were $24 million, or $5 million higher in the first quarter than in the year-ago period, driven by higher transactional foreign exchange losses related to country-specific net working capital balances.

- Reported and adjusted effective tax rates for the quarter were 28.9 percent and 28.9 percent, respectively, for the period compared to (29.3) percent and 29.5 percent, respectively, in the year-ago period. The increase in the reported effective tax rate resulted primarily from the prior year impact of impairment charges related to the Arcor joint venture in Argentina recorded in 2021. The decrease in the adjusted effective tax rate resulted primarily from favorable foreign exchange impacts, partially offset by new U.S. tax regulations that reduced the Company’s ability to claim certain foreign tax credits against U.S taxes.

- First quarter capital expenditures were $85 million, up $20 million from the year-ago period.

2022 Second Quarter Outlook and Full-Year Perspective

For the second quarter 2022, the Company expects net sales to increase by low double-digits and operating income growth to be relatively flat, when both are compared to second quarter 2021.

The Company expects full-year 2022 reported EPS to be in the range of $6.80 to $7.40, and maintains its expectation of adjusted EPS to be in the range of $6.85 to $7.45, compared to adjusted EPS of $6.67 in 2021. This expectation excludes acquisition-related integration and restructuring costs, as well as any potential impairment costs.

Compared with last year, the 2022 full-year outlook assumes the following: North America operating income is expected to be up low to mid-double-digits, driven by favorable price mix more than offsetting higher corn and input costs; South America operating income is expected to be up low single-digits, driven by favorable pricing; Asia-Pacific operating income is expected to be flat compared to the prior year period, driven by higher corn costs in Korea related to the Ukraine conflict, offsetting PureCircle growth; EMEA operating income is expected to be up low single-digits, driven by favorable price mix. Corporate costs are expected to be flat.

The Company expects full-year adjusted operating income to be up low double-digits.

For full year 2022, the Company expects a reported effective tax rate of 27.0 percent to 30.5 percent and an adjusted effective tax rate of 28.0 percent to 29.5 percent. The increase in the reported and adjusted full year effective tax rate is driven by favorable foreign exchange impacts, which were partially offset by new U.S. tax regulations that reduced the Company’s ability to claim certain foreign tax credits against U.S. taxes.

Cash from operations for full-year 2022 is expected to be in the range of $580 million to $660 million. Capital expenditures for the full year are expected to be between $300 million and $335 million.

Media contact

Roshini Bains

Editor, International Bakery

Tel: +44 (0) 1622 823 922

Email: editor@in-bakery.com