How ongoing innovation is helping clean label to win the battle of shelf life extension in cookies and baked goods, whilst meeting consumer demand for long-lasting healthy but indulgent foods.

As the Covid-19 pandemic continues to have an enormous impact on consumers across the globe, today’s market for baked goods is evolving at a record pace. Specifically, the pandemic has become a driving factor in increasing consumer demand regarding transparency, as more people have become aware of supply chain factors that could potentially impact health and safety.

The amount of information which is now available to consumers, combined with ever-increasing trends towards healthy eating, product safety and sustainability, have created an environment where it is challenging for companies to keep up. The move towards clean label, organic and better-for-you products in particular appears to be here to stay, however combined with this, consumers are also looking for indulgent sweet treats as a comforting mood boost during these current uncertain and stressful times.

It’s a tough balance to strike, but research by Mintel found that 35% of snacking consumers are replacing treat-worthy indulgent snacks with healthier options, or at least options which are classified as clean label, allowing consumers to ‘have their cake and eat it’ so to speak. Brands can take advantage of this trend, by incorporating clean label ingredients into their products providing options for permissible indulgence, however recreating popular sweet treats in a clean label or organic format is not without its challenges.

Alongside the demand for organic, clean label options, there is also an expectation from consumers that comfort foods such as cookies and cakes will still have the same qualities they’ve come to know and love in terms of flavours, appearance and shelf-life, but all without the additives.

Creative innovations are starting to come to the fore in terms of natural colourings, flavourings and sweeteners, as seen in the increased use of stevia and other natural sweeteners in recent times. But achieving clean label or organic status whilst still maintaining the same shelf life available to non-clean label competing products presents a more elusive goal. For example, a study carried out by MSNBC’s consumer correspondent team found that upon lab testing, samples from a range of fresh organic products contained much higher levels of the kinds of bacteria which cause food to spoil compared to their non-organic counterparts, ultimately translating to a potentially shorter shelf life.

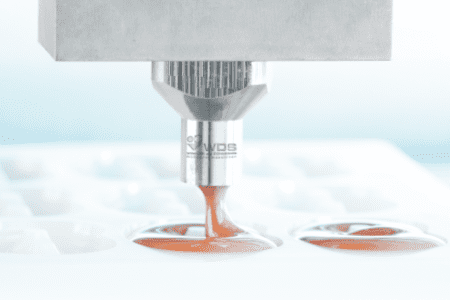

Produced using a combination of selected wheat flour qualities and untreated spring water, sourced at the production facility in Germany, Kröner-Stärke’s cookie filling solution can be used by food manufacturers to shorten ingredients lists, whilst maintaining the sensory attributes and fresh keeping qualities so favoured by consumers.

Because of its specialised production process, the use of this newly developed solution is providing cookie fillings that can be used in certified clean label and organic products whilst still achieving excellent fresh keeping properties. The fact that this filling material can produce a cream-like substance without the use of dairy ingredients also means that it can be used in products aimed at consumers embracing the increasingly popular vegan lifestyle, countering concerns about the sometimes highly processed and artificial nature of many vegan alternatives available on the market today.

The increasingly broad range of products carrying the term ‘clean label’, including those traditionally thought of as indulgent treats, is an indication of the way in which this movement has evolved beyond a healthy eating trend, and more towards an ideology and lifestyle choice, encompassing traceability, ethical concerns and sustainability.

“Cookies tend to have nostalgic connotations, providing a comfort factor that means they will remain a priority purchase for many consumers”

Pushing for premium

From traditional favourites like digestives and rich tea, to more adventurous flavour combinations, the cookie jar is overflowing with choices and cookies are a staple in many consumers’ diets. However, there has been a sharp rise in premium, private label cookie innovation since the start of the coronavirus pandemic and we are seeing an already crowded market become even busier. This shift in favour to premium products shows no signs of stopping, but there are other factors at play, too. Pressure on manufacturers to reduce the sugar and calorie content of their products is at an all-time high and consumers have shifting priorities as they adapt to life as we now know it.

The challenge for cookie makers is how to continue to develop innovative, premium products that appeal to consumers, all while responding to new trends and improving the nutritional content of their goods.

The increased interest in premium products is one of the main trends we are seeing in the cookie category. Despite economic challenges resulting from the pandemic, many consumers are driven to private label offerings as they seek affordable luxuries, with 10.1% of cookie/biscuit launches between March 2020-February 2021 carrying a premium label (up from 2.5% in 2019-2020), compared to 6.6% ‘economy’ launches.

Some of the key factors influencing this trend are provenance, indulgence and nostalgia, all of which can help signpost consumers to the fact that a product is premium. Cookies tend to have nostalgic connotations, providing a comfort factor that means they will remain a priority purchase for many consumers. It is this popularity that drives innovation within the category, with manufacturers seeking to push the boundaries of premium to find space on the shelf and differentiate from other products. Labelling cookies with markers like traditional recipes or authentic premium ingredients, such as Madagascan vanilla, are key ways to attract consumer attention and provide reassurance about the provenance of a product. By using typically indulgent flavours such as milk chocolate and salted caramel, manufacturers can also appeal to consumers looking for a more decadent product that serves as a treat. 71% of Italian consumers say that they eat cookies as part of having ‘me time’, and it is this emotional connection that makes them such a comforting food.

Finding the sweet spot

While comfort has been important for many consumers through a difficult time, the pandemic has also exaggerated the shift to products that are deemed ‘healthier’. Although cookies are associated with indulgence, there is increasing pressure for manufacturers to help relieve some of the perceived guilt around such treats. While 70% of consumers feel that manufacturers have a duty to make unhealthy foods healthier, 84% also agree that taste is the most important factor for them when choosing a product.

In 2018, Public Health England set out the maximum number of calories per portion of cakes, cookies, muffins and morning goods as 325kcal, and there is a move to a holistic approach to cut calories through reduced fat and sugar.

There is currently a gap in the market for premium private label products with reduced sugar claims – the number of branded premium cookie launches with a no added sugar claim tripled between March 2018 and February 2021, while there were no launches of this kind in premium private label.

However, formulating these recipes is a challenge as sugar is a key ingredient in cookies, contributing indulgence, sweet taste and influencing flavour perception. Reducing sugar can significantly impact sweetness, caramelisation and flavour impact, so it is important to look at ways in which the balance can be redressed. Synergy Flavours has launched a unique flavour-based ingredient that enables significant reductions in sugar and calories in a range of baked goods, including cookies. This all-natural, next generation ingredient combines flavour technology, functionality and mouthfeel, to replicate the taste and texture typical of baked goods, but within reduced calorie recipes.

Looking to nature

One way that manufacturers are creating reduced-sugar options is by using ‘less sweet’ flavour profiles such as botanicals, florals and citrus, as an easy way to cut down on sugar. Dark chocolate is also rapidly gaining favour with consumers due to its health image with 3.5% growth predicted by 2021 vs 2.1% growth of milk chocolate (Euromonitor). These types of flavour profiles reduce the need for sweetness within a product and therefore offer consumers a more balanced product that is naturally low in sugar. One example of a product ticking the boxes of both premium and ‘better for you’ is the McVitie’s Crunchy Granola Oat Bakes with Dark Chocolate and Almond – these ingredients all have a health halo and are perceived to therefore be a better choice, and the granola label helps to position it as a premium product.

With cookies remaining high on the shopping list, it is important to understand the drivers behind consumer demands in order to create the quality products that they are looking for. However, growing expectation for products to have reduced sugar, fat and/or calories, as well as vegan options, without any compromise on taste or texture means that manufacturers must look closely at how they reformulate products. It is possible to create cookies with fewer calories, but the same great taste that consumers know and love. Focusing on flavour and functionality is key and innovative ingredients are helping manufacturers to deliver these products.

Henrik de Vries, Commercial Manager at Kröner-Stärke says:

“When it comes to bakery produce, when unbaked parts of a product such as cream-like fillings for cookies and pastries are taken into consideration, these cannot benefit from the effects of the baking process in limiting bacteria, and so normally rely on artificial food additives to extend shelf life.

A solution to this dilemma has been developed by Kröner-Stärke for such fillings based on a hot-swelling wheat starch, which is produced under an extremely stringent hygienic process. Production of this ingredient can only take place once enhanced microbiological cleaning has been carried out on all equipment beforehand to create an aseptic environment. Following production, the finished starch is then subjected to an extended microbiological analysis covering a broad spectrum of potential contaminants, to ensure that the bacteria count is as close to zero as is technically possible.

Following this process, the starch is stored in specially adapted conditions to prevent cross-contamination or any influences from external conditions impacting upon the quality of the product. Once purchased by food manufacturers, providing it is stored in cool and dry conditions, and kept in its original packaging, this ingredient has a shelf life of at least 24 months, and provides excellent fresh-keeping qualities when used as the basis for unbaked fillings in finished bakery products,” he explains.

The product is currently being used as a clean label cookie filling, and being a dried ingredient, viscosity can easily be adjusted to achieve the required texture for a range of finished products. Potential applications include numerous ‘wet’ uses such as fillings, toppings, sauces and dressings, or alternatively, it can be used as a component in dry baked goods and baking mixes. As the wheat starch has very high water binding capacity, it provides the potential to increase yields and present a cost-effective alternative to expensive raw materials. The hot-swelling starch also has comparable technological properties to standard native starches, so it can easily be used to replace these in formulations for finished products as a clean label or organic alternative.”

Lorraine Kelly, Category Manager, Synergy Flavours says:

“Plant-based is still a relatively new trend in the bakery category, but it has seen significant growth in the past five years with product launches carrying a ‘vegan’ claim increasing by almost 170% since 2015, with biscuits and cookies accounting for 6% of European bakery launches with such claims.

Traditionally, most cookies are made using animal-derived products such as milk, butter, and eggs, all of which contribute to their rich and indulgent flavour and texture. Dairy ingredients also offer functional benefits to the recipe, as well as taste, so removing them can lead to implications such as structural and textural changes, shelf-life challenges, and flavour inconsistencies.

Primary research from Synergy Flavours found that 24% of consumers wanted plant-based products to taste more like traditional products. To overcome the potential differences in taste and texture, manufacturers must look at reformulating the entire recipe, rather than swapping out individual ingredients. The challenge with plant-based alternatives to traditional ingredients is that they may possess undesirable flavours or off-notes, which can impact on overall flavour delivery.

For plant-based recipes or reformulations, Synergy’s vegan flavour solutions are designed to deliver authentic taste, added functionality (such as enhanced process stability), and long-lasting mouthfeel to plant-based products, by mimicking the characteristics and flavour of traditional ingredients. The solutions can restore the ‘brown’ and ‘cooked’ aromas which typically come from eggs, and also the ‘creamy’ and ‘buttery’ aromas, which are lost when butter is removed from recipes.”

To stay up to date on the latest, trends, innovations, people news and company updates within the global bakery market please register to receive our newsletter here

Media contact

Kiran Grewal

Editor, International Bakery

Tel: +44 (0) 1622 823 922

Email: editor@in-bakery.com